There are a number of basic steps you can take to safeguard your personal information and financial accounts, as well as some more advanced services you can tap to automate your ability to track suspicious activity and potential exposure of your data.

Consider using credit freezes or fraud alerts. These make it more difficult for fraudsters to secure loans or credit cards in your name. A credit freeze prevents anyone from checking your credit report or credit score (typically the first step creditors will take in reviewing applications for loans or credit cards). A fraud alert requires creditors to verify your identity before processing any application made in your name. Both of these free services make it harder for criminals to seek credit using your identity.

How long does a security freeze last?

A security freeze will remain on your credit file until you remove it.

How can I unfreeze my credit file?

You can permanently remove/lift a security freeze on your credit file with one click or schedule an unfreeze for a specified time period. A security freeze can limit access to your credit, even if it was authorized by you. If you know you are going to apply for new credit, you can plan ahead and unfreeze or schedule an unfreeze, before you apply.

How long does it take to place or remove a security freeze?

You can freeze and unfreeze your Experian credit file in real time using the online services.

Explore each of the credit reporting agencies below by clicking the link under the logo. If you place a security freeze on your one credit report, it is not automatically shared with other credit reporting agencies. We suggest, at minimum, you freeze all 3.

Links are below:

IRS: Get an identity protection PIN (IP PIN)

An identity protection PIN(IP PIN) is a six-digit number that prevents someone else from filing a tax return using your Social Security number (SSN) or individual taxpayer identification number (ITIN). The IP PIN is known only to you and the IRS. It helps us verify your identity when you file your electronic or paper tax return. Even though you may not have a filing requirement, an IP PIN still protects your account.

SSA

April 1, 2025: The Social Security Administration (SSA) Office of the Inspector General (OIG) is cautioning the public to be aware of emails that appear to be from SSA and include a link to download their Social Security statement.

"Be on the lookout for fake calls, texts, emails, websites, messages on social media, or letters in the mail."

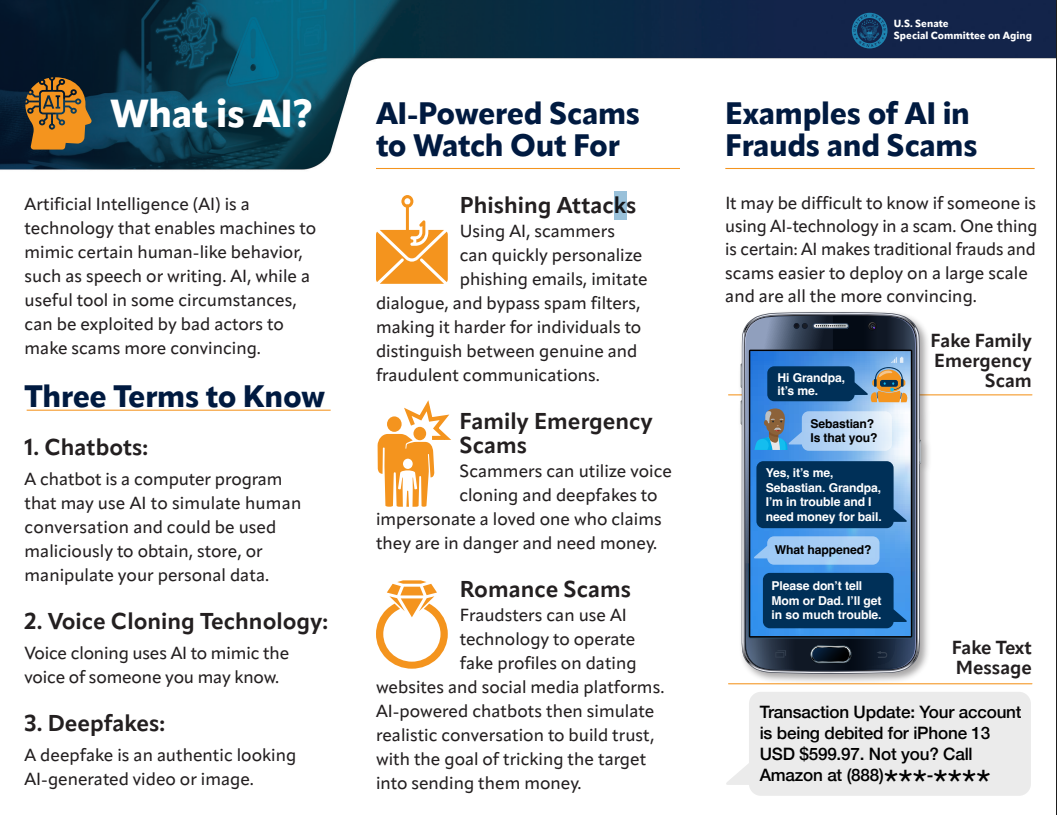

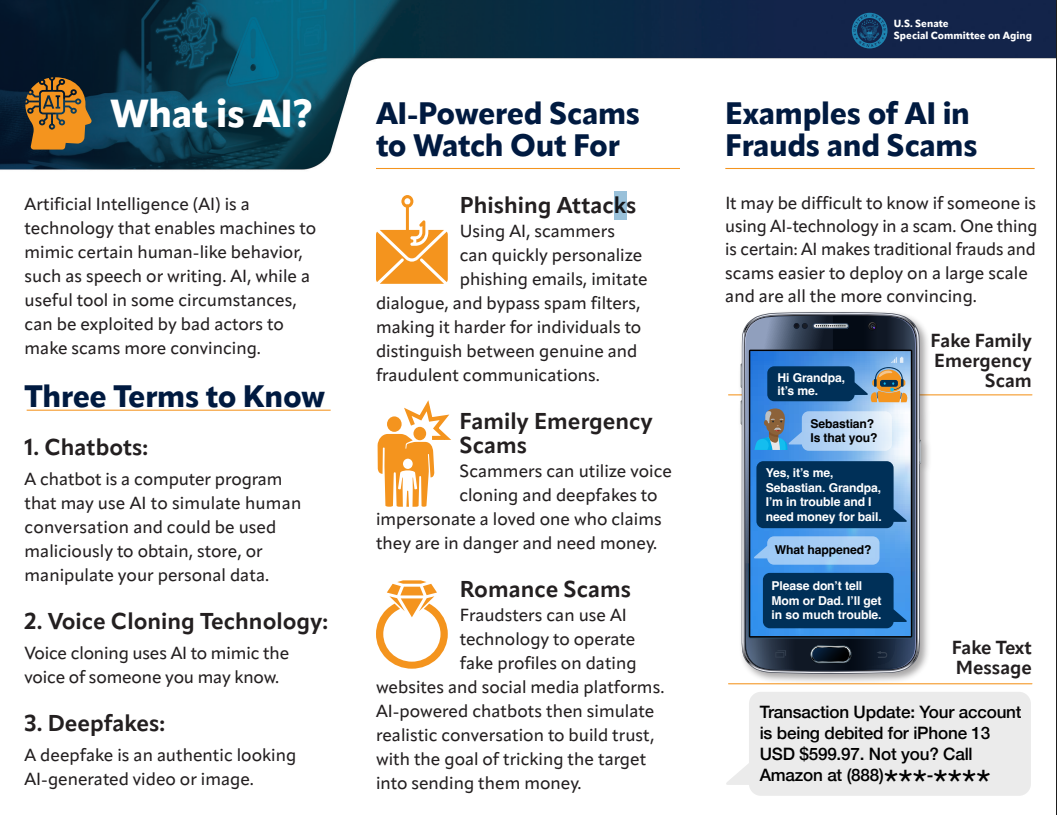

Scammers have also been known to:

• Use legitimate names of Office of Inspector General or Social Security Administration employees.

• “Spoof” official government phone numbers, or even numbers for local police departments.

• Send official-looking documents by U.S. mail or attachments through email, text, or social media message.

Known Tactics Scammers Use

These are red flags; you can trust that Social Security will never

• Threaten you with arrest or legal action because you don't agree to pay money immediately.

• Suspend your Social Security number.

• Claim to need personal information or payment to activate a cost-of-living adjustment (COLA) or other benefit increase.

• Pressure you to take immediate action, including sharing personal information.

• Ask you to pay with gift cards, prepaid debit cards, wire transfers, cryptocurrency, or by mailing cash.

• Threaten to seize your bank account.

• Offer to move your money to a “protected” bank account.

• Demand secrecy.

• Direct message you on social media.

We urge you to stay vigilant.

If you are a victim of a scam properly report it, as well as let our office know.

Advisory services offered through Osaic Wealth, Inc. Securities offered through Osaic Wealth, Inc. Member FINRA/SIPC. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Heritage Harbor Financial Associates and Osaic Wealth, Inc are separate entities.